スタジオアミ撮影券

(税込) 送料込み

商品の説明

スタジオアミの撮影券と割引券です。

里帰り先でもらいましたが使用する機会がないので出品します。

①撮影料無料 木製フレーム付き写真プレゼント

②割引券

2枚セットです。商品の情報

| カテゴリー | ベビー・キッズ > 行事・記念品 > その他 |

|---|---|

| 商品の状態 | 新品、未使用 |

スタジオアミ撮影券 80%以上節約 - その他

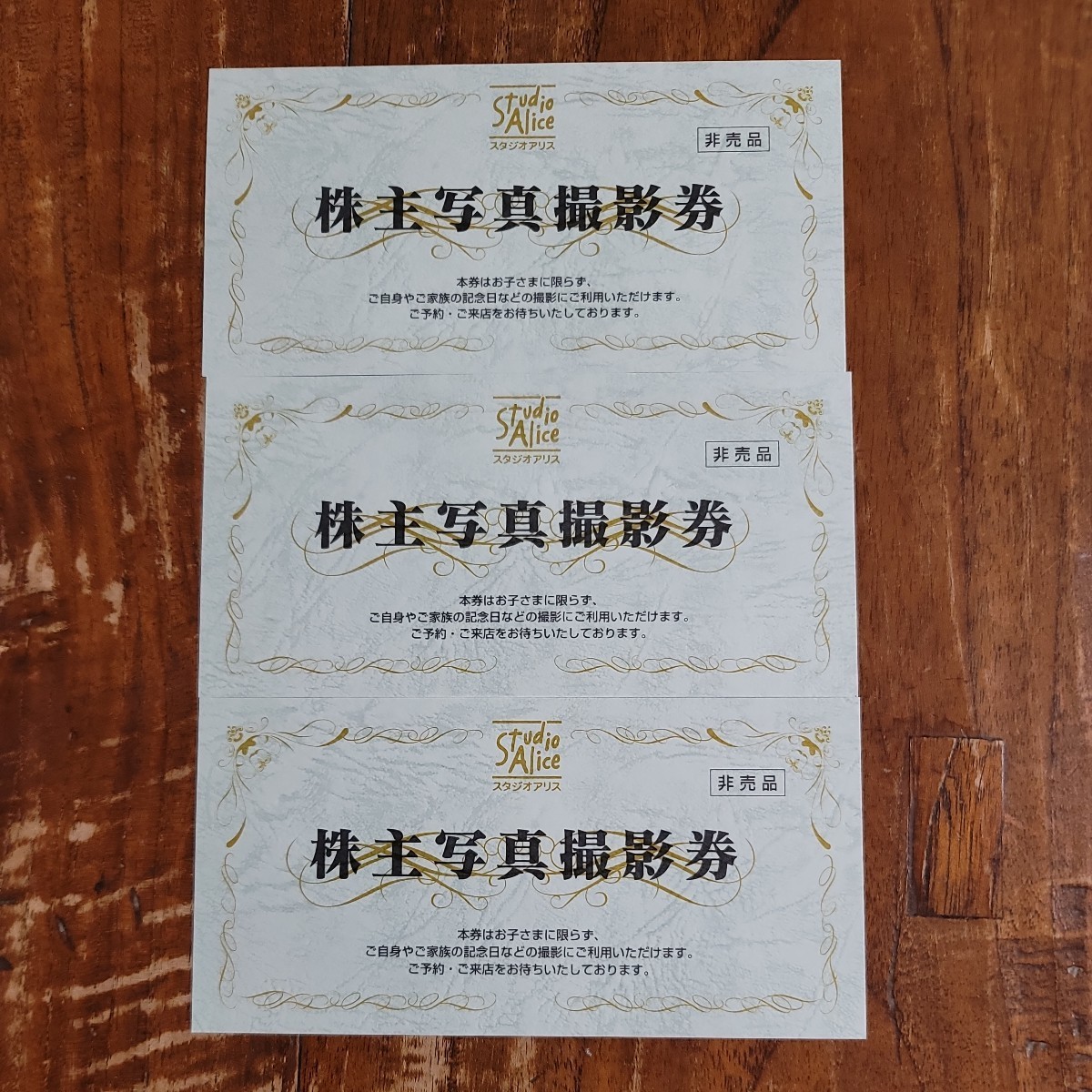

スタジオアミ 撮影券 クーポン券 お宮参り 優待券

スタジオアミ 撮影割り引き券の通販 by らら's shop|ラクマ

スタジオアミ撮影券 - その他

スタジオアミ撮影券 - その他

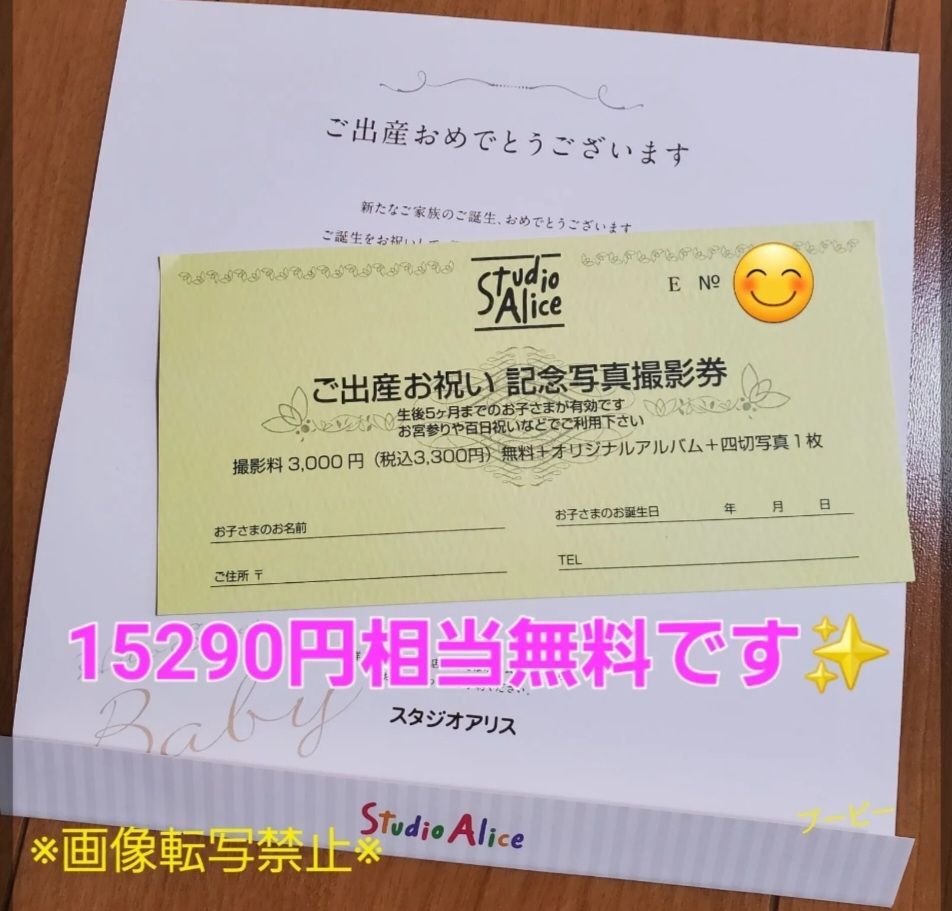

即発送【 スタジオアリス 】 撮影無料券 クーポン オリジナルアルバム

スタジオアミ撮影券 - その他

スタジオアミ 無料プレゼント券

スタジオアミ 赤ちゃん撮影 無料プレゼント券の通販 by ina|ラクマ

スタジオアミ撮影券 - その他

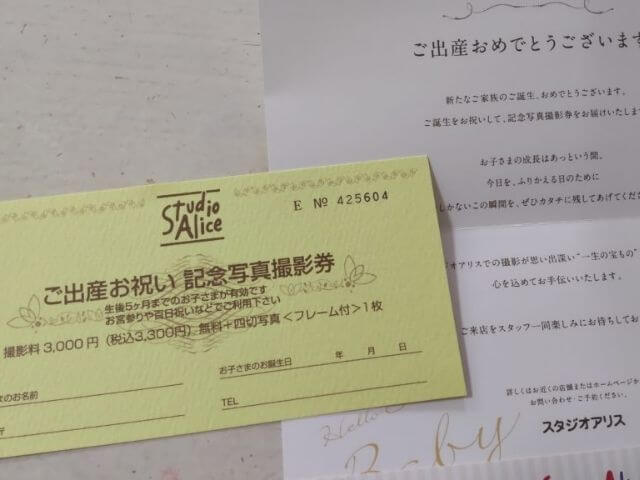

スタジオアリス ご出産お祝い記念写真撮影券 撮影料無料 - 割引券

スタジオアミ 撮影料無料券 | フリマアプリ ラクマ

スタジオアミ 撮影券 クーポン券 お宮参り 優待券

スタジオアミ 撮影 - 遊園地

スタジオアミ 割引券 - 割引券

写真館 スタジオアミ優待券の通販 by こまさんs shop|ラクマ

スタジオアミ 撮影 - 遊園地

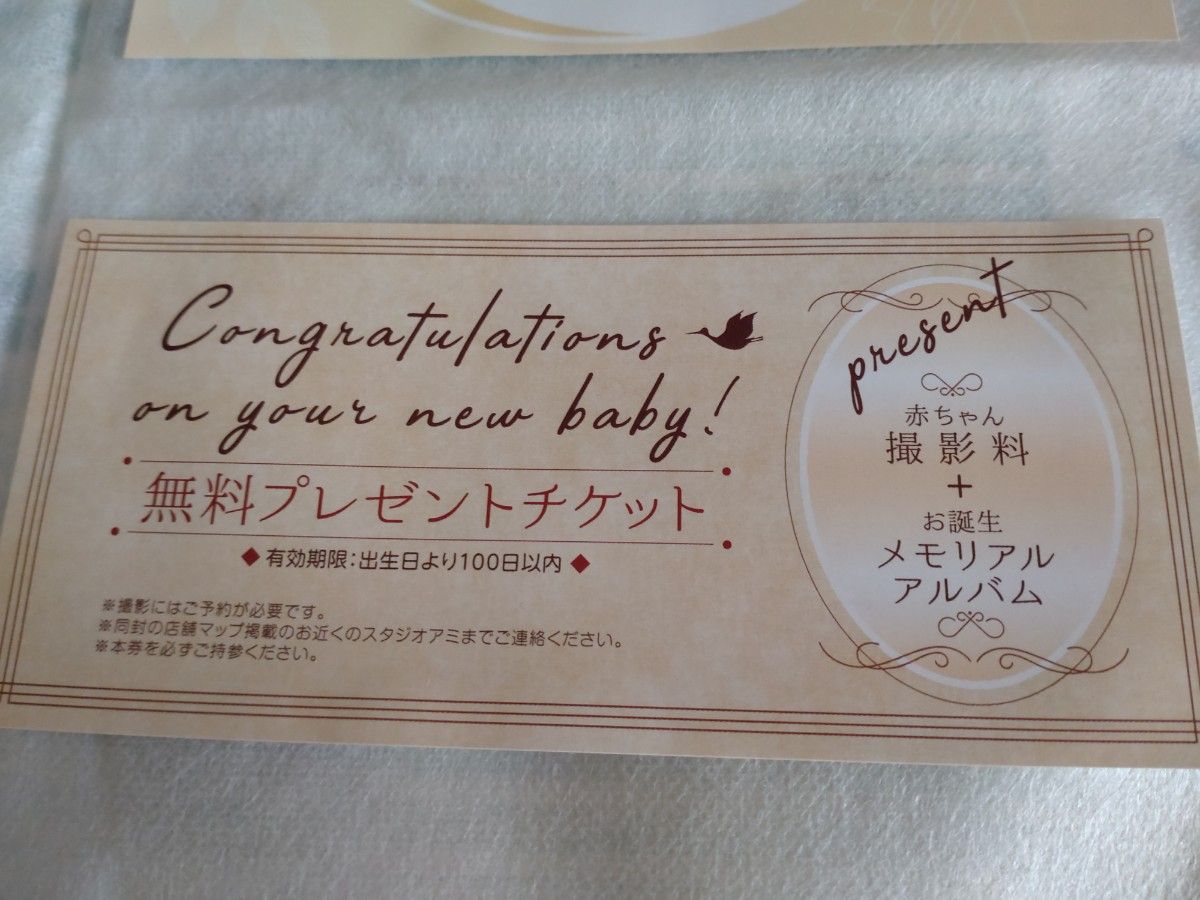

スタジオアミ無料撮影+お誕生メモリアルアルバム券(優待券、割引券

アミのご入園・ご卒園・小学校ご入学キャンペーン|キャンペーン|写真

【東北9店舗対象】スタジオアミ 撮影料無料プレゼントチケット

よくある質問|写真専門スタジオアミ|七五三、入園、入学や家族写真

最近、お問合せの多い百日撮影のご案内パンフレット・価格表です

スタジオアリスの赤ちゃん撮影|こども写真館スタジオアリス|写真

スタジオアミ 無料プレゼント券 | フリマアプリ ラクマ

よくある質問|写真専門スタジオアミ|七五三、入園、入学や家族写真

スタジオアミ 赤ちゃん撮影 無料プレゼント券の通販 by ina|ラクマ

最近、お問合せの多い百日撮影のご案内パンフレット・価格表です

![スタジオアミ 盛岡南館[マタニティフォト専門サイトフォトハグ]](https://photohug-production.s3-ap-northeast-1.amazonaws.com/uploads/studio_image/image/1763/_____01.jpg)

スタジオアミ 盛岡南館[マタニティフォト専門サイトフォトハグ]

スタジオアリス 記念写真・撮影無料券(生後5ヶ月までのお子様対象)

1/2成人|撮影メニュー|写真専門スタジオアミ|七五三、入園、入学や

スタジオアミ 撮影料無料+アルバム チケット|mercariメルカリ官方指定

スタジオアリス撮影券 - プール

オマケ付き!写真専門スタジオ アミ 特別優待券 - 割引券

スタジオアミ 撮影料無料券

【東北9店舗対象】スタジオアミ 撮影料無料プレゼントチケット

アミのご入園・ご卒園・小学校ご入学キャンペーン|キャンペーン|写真

キャンペーン情報|こども写真館スタジオアリス|写真スタジオ・フォト

スタジオアミ坂戸館

七草|鹿児島 七草 写真【スタジオアミ鹿児島】

スタジオアミ 赤ちゃん撮影 無料プレゼント券の通販 by ina|ラクマ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています